Fraud detection is a critical challenge for the financial industry, with billions of dollars lost annually to fraudulent activities. Traditional methods, while useful, often fail to keep pace with increasingly sophisticated fraud tactics. Enter artificial intelligence (AI)—a technology rapidly transforming how financial institutions identify and respond to fraud in real time. Leveraging advanced techniques like machine learning, predictive analytics, and anomaly detection, AI has revolutionized the fight against financial crime.

Now let's explore the role of AI in reshaping fraud detection within financial transactions. We will examine the key technologies driving this transformation, highlight real-world applications, and detail the numerous benefits alongside the challenges that accompany AI's integration into the financial ecosystem.

Fraud Detection in Financial Transactions: The Evolution of Strategy

Historically, fraud detection relied on rule-based systems, manual reviews, and historical data analysis. While effective in identifying known patterns, such methods struggled to adapt to evolving threats. Cybercriminals continually developed new schemes, making these static systems inadequate for modern challenges.

AI introduces a dynamic and scalable approach to fraud detection. By analyzing vast data sets and learning in real time, AI systems can detect subtle anomalies, identify unknown fraud patterns, and reduce response times. Financial institutions are now better equipped to proactively combat fraud, offering a safer experience to their customers.

Key AI Technologies in Fraud Detection

Several AI-driven technologies are at the forefront of modern fraud detection efforts. These tools enable financial institutions to identify and mitigate fraudulent activities with higher precision and efficiency.

1. Machine Learning

Machine learning (ML) is a subset of AI that enables systems to learn and improve from data without explicit programming. It plays a foundational role in fraud detection by analyzing historical transaction data to identify patterns that indicate fraudulent behavior. ML models are continually updated with new data, which enhances their ability to adapt to emerging fraud techniques.

JPMorgan Chase uses proprietary ML algorithms to analyze vast amounts of transactional data. These models can identify unusual activity, such as unusual transaction amounts or foreign purchases outside the user's typical spending patterns.

Benefits:

- Adaptive systems that evolve with new fraud trends.

- Improved ability to detect previously unknown fraud schemes.

2. Predictive Analytics

Predictive analytics combines data mining, statistical modeling, and AI to forecast potential fraudulent activity. These systems look at historical and real-time data to predict where and how fraud might occur, enabling preemptive actions. Predictive models also provide risk scores for transactions, helping financial institutions prioritize their responses.

PayPal employs predictive analytics to analyze billions of daily transactions, assigning each a risk score. Suspicious transactions are flagged for review, allowing the platform to stop scams before they impact users.

Benefits:

- Proactive fraud prevention.

- Accurate risk assessment across diverse transaction types.

3. Anomaly Detection

Anomaly detection focuses on identifying transactions that deviate significantly from a customer's normal behavior. By using AI to establish a baseline for an individual's spending habits, these systems can spot irregularities that suggest potential fraud. This method is particularly effective in addressing low-frequency, high-risk fraud scenarios.

Visa uses AI-driven anomaly detection to monitor transactions across its global network. The system identifies instances where card usage deviates from established patterns, such as unexpectedly large withdrawals or high-value purchases outside a user's usual region.

Benefits:

- Real-time identification of suspicious activity.

- Enhanced detection accuracy through behavioral analysis.

Real-World Applications

AI-driven fraud detection systems are already widely adopted across the financial sector, with banks, fintech companies, and payment processors leveraging this technology to safeguard their operations.

Banking Sector

Global banking institutions like HSBC, Wells Fargo, and Citibank have integrated AI into their fraud detection frameworks. HSBC, for instance, employs AI to analyze customer transactions for signs of financial crime. The bank's system uses deep learning models to cross-reference transaction data with known fraud patterns, ensuring a highly accurate detection process.

Fintech Companies

Fintech platforms are often at the forefront of innovation, and many have adopted AI to enhance fraud prevention. For example, online payment platforms like Stripe and Square use AI-powered tools to monitor transactions and detect fraudulent payments. These tools are particularly valuable in high-transaction environments, where manual reviews would be infeasible.

Credit Card Companies

Major credit card providers, including Mastercard and American Express, deploy AI to identify even the most sophisticated fraud schemes. By analyzing both transactional and non-transactional data (such as login behavior), these systems can detect unusual patterns and prevent unauthorized access.

Benefits of AI in Fraud Detection

AI offers several advantages over traditional fraud detection methods, each contributing to a safer financial ecosystem.

1. Real-Time Detection

AI systems process data at incredible speeds, enabling real-time fraud detection. This is crucial in preventing fraudulent transactions from being completed and mitigating financial losses.

2. Reduced False Positives

Traditional fraud detection systems often generate false positives, flagging legitimate transactions as suspicious. By using advanced algorithms and contextual analysis, AI significantly reduces false positives, improving the customer experience while maintaining security.

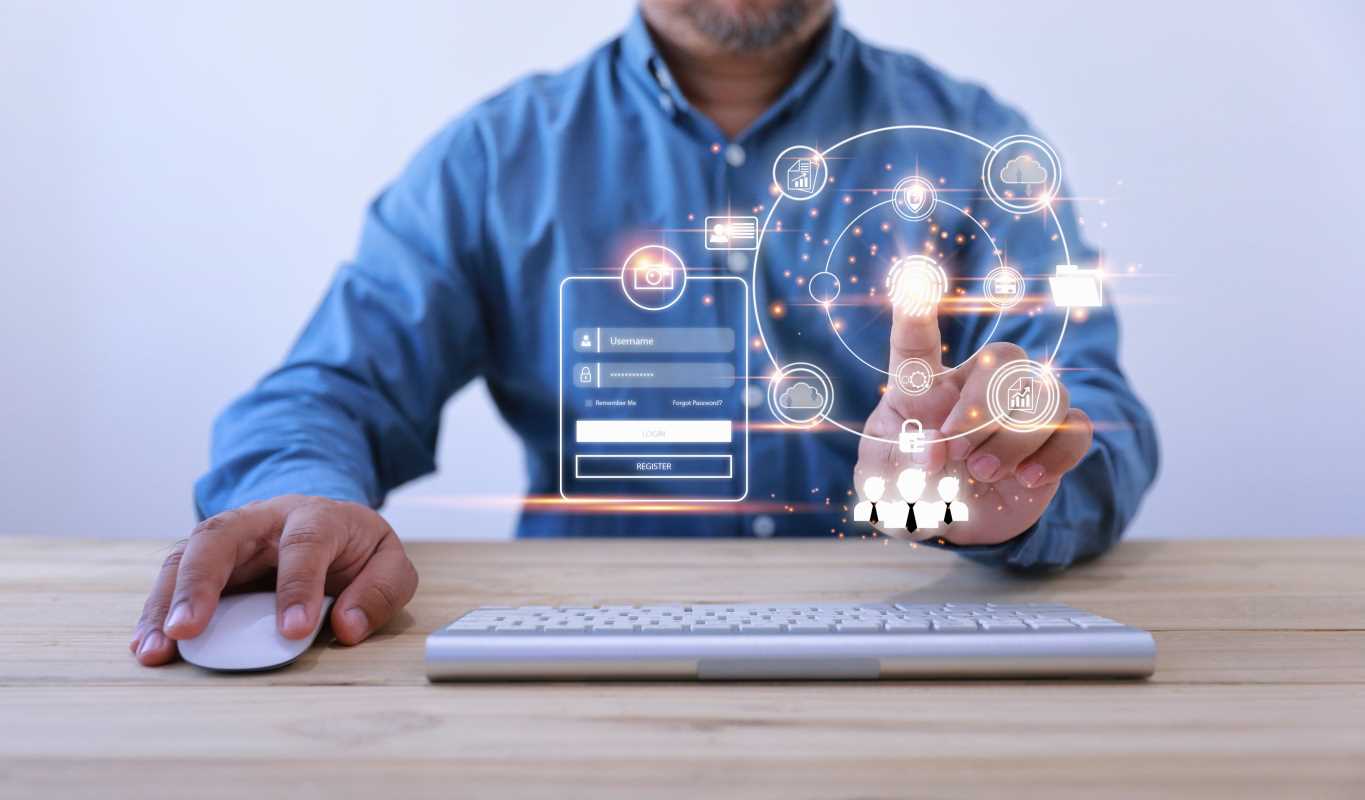

3. Enhanced Security

AI enables robust multi-layered security by combining techniques like machine learning, user behavior analysis, and biometric authentication. These systems make it increasingly difficult for fraudsters to bypass security measures.

4. Operational Efficiency

Automation reduces the need for manual reviews, allowing human resources to focus on high-priority cases. This increases efficiency while lowering operational costs.

5. Scalability

AI systems can handle vast amounts of data, making them suitable for organizations of all sizes, from small fintech startups to large multinational banks.

Challenges of Using AI in Fraud Detection

Despite its benefits, integrating AI into fraud detection systems is not without challenges. Financial institutions must address these issues to maximize AI's effectiveness.

1. Algorithmic Bias

AI models are only as reliable as the data they are trained on. Biased or incomplete data sets can lead to unfair outcomes, such as disproportionately flagging transactions from certain customer segments. Addressing algorithmic bias requires careful model design and ongoing monitoring.

2. Data Privacy Concerns

AI-driven fraud detection relies on vast amounts of sensitive customer data. Financial institutions must prioritize data security and comply with regulations like GDPR and CCPA to prevent breaches and misuse.

3. High Implementation Costs

Developing and maintaining AI systems can be expensive. For smaller organizations, these costs may be prohibitive without access to affordable AI-as-a-service solutions.

4. Evolving Fraud Tactics

While AI is highly effective, fraudsters are continually finding new ways to exploit vulnerabilities. AI systems must be regularly updated and monitored to stay ahead of emerging threats.

The Future of AI in Fraud Detection

AI's role in fraud detection will continue to expand as the technology becomes more advanced. Several trends are likely to shape the future of this field:

- Explainable AI: Enhancing transparency in AI decision-making will allow businesses to better understand why certain transactions are flagged.

- Cross-Industry Collaboration: Financial institutions may collaborate to share fraud data, enabling more comprehensive AI models capable of identifying wider fraud networks.

- Advanced Behavioral Analytics: AI systems will incorporate more complex behavioral patterns, such as micro-expressions or voice tone, to identify fraud attempts.

(Image via

(Image via

.jpeg)