The onboarding process is a foundational component of any organization's customer or employee experience. Whether it's welcoming new customers to a fintech platform, verifying users for an e-commerce service, or bringing employees into a company, an efficient onboarding process can establish trust and lay the groundwork for long-term engagement. However, traditional onboarding methods often rely on manual checks and physical documentation, leading to delays, security vulnerabilities, and a poor user experience. Digital identity verification is revolutionizing this process, offering businesses a fast, secure, and user-friendly solution.

This post explores how digital identity verification technologies like biometric authentication, AI-driven document verification, and blockchain are transforming onboarding processes. We’ll examine their benefits, challenges, and real-world applications to demonstrate why this innovation is essential for modern businesses.

Understanding Digital Identity Verification

Digital identity verification is the process of confirming an individual's identity using technology-driven methods. Unlike traditional verification procedures that rely on physical documentation and in-person scrutiny, digital identity verification leverages advanced tools to establish authenticity remotely. The process can involve checking official documents, verifying biometric data, cross-referencing online activity, and more.

This approach has become increasingly important as businesses expand their digital services. From signing up for a new bank account to applying for a job online, onboarding now occurs in virtual environments where trust, speed, and security are paramount.

Key Technologies Driving Digital Identity Verification

Several cutting-edge technologies power digital identity verification solutions. Each contributes uniquely to streamlining the onboarding process:

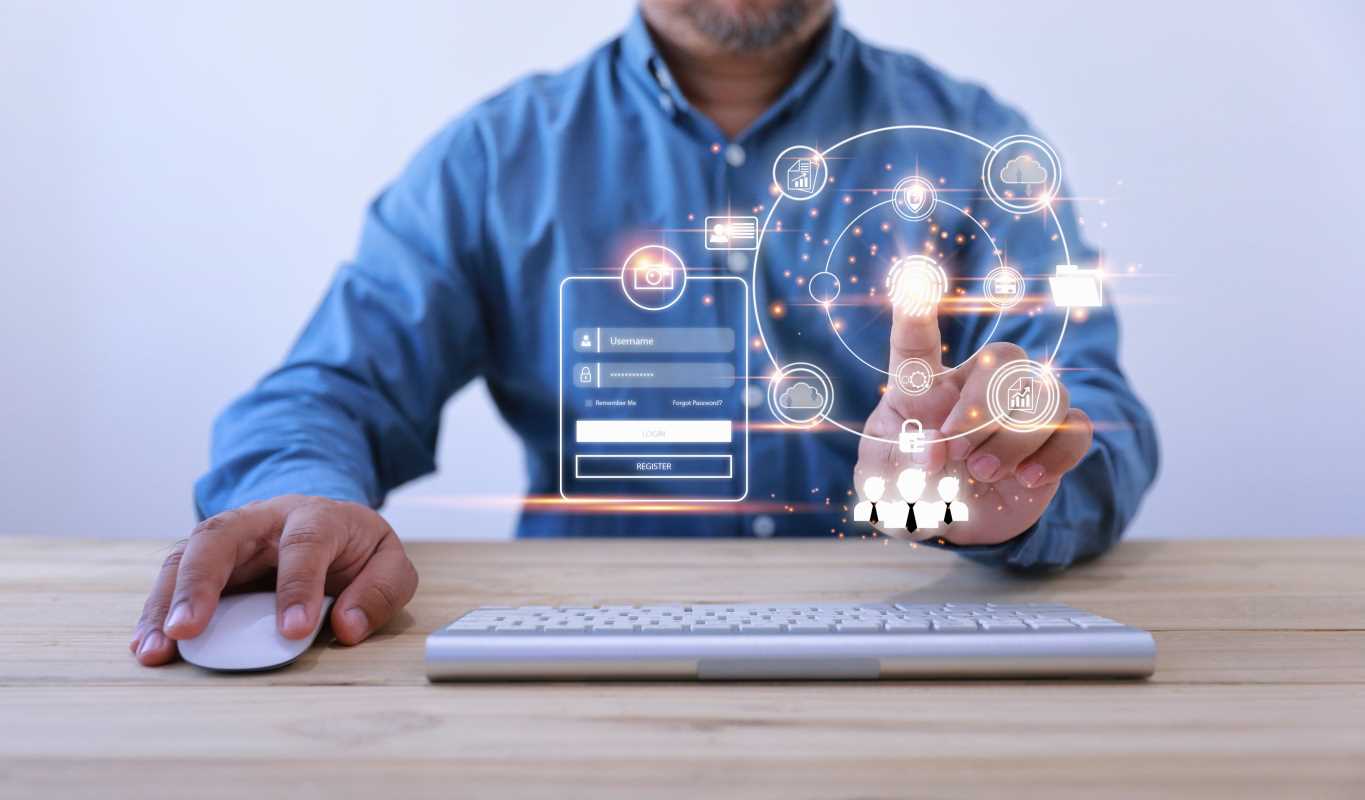

1. Biometric Authentication

Biometric authentication uses unique physical or behavioral characteristics, such as fingerprints, facial features, or voice patterns, to verify identity. This approach is highly secure because biometric data is difficult to replicate.

Example

Apple's Face ID, widely used for authentication on iPhones, exemplifies the convenience and security brought by biometric technology. Similarly, government agencies worldwide have adopted biometric verification tools for passport control and voter registration.

Benefits:

- Instant identity confirmation.

- Reduced reliance on passwords, which can be forgotten or hacked.

- Enhanced user experience through seamless integration.

2. AI-Driven Document Verification

Artificial intelligence (AI) is transforming document verification by automating the process of examining identity documents such as passports, driver’s licenses, or ID cards. AI models can detect forgeries, validate document authenticity, and extract data with remarkable accuracy.

Example

Platforms like DocuSign and Jumio use AI for real-time document scanning and verification, enabling businesses to complete onboarding within minutes instead of days.

Benefits:

- Faster processing times compared to manual checks.

- Greater accuracy in detecting fraudulent documents.

- Scalability for high-volume onboarding needs.

3. Blockchain for Identity Management

Blockchain, the decentralized ledger technology, is increasingly being used in identity management systems. Blockchain ensures that personal data remains immutable and tamper-proof, giving users more control over their information. With secure cryptographic methods, blockchain enables self-sovereign identities, allowing individuals to share only the information necessary for verification without exposing sensitive details.

Example

The Sovrin network offers a decentralized identity solution based on blockchain, enabling users to verify their credentials securely without sharing unnecessary personal data.

Benefits:

- Improved data transparency and integrity.

- Enhanced privacy for users by minimizing data exposure.

- Global accessibility for cross-border transactions or interactions.

Key Benefits of Digital Identity Verification in Onboarding

Digital identity verification offers substantial advantages that address the inefficiencies and vulnerabilities of traditional processes. Here’s how businesses can benefit:

1. Reduced Fraud

One of the standout advantages of digital identity verification is its ability to mitigate fraud. Advanced tools can identify forged documents, detect suspicious user behavior, and cross-reference data with trusted sources to ensure authenticity. Features like biometric authentication add another layer of security that is nearly impossible for fraudsters to bypass.

According to a widely cited study, businesses implementing biometric or AI-driven verification saw a 30% reduction in fraudulent account creation. This reflects how technological integration can safeguard company revenue while maintaining trust.

2. Faster Processing Times

Manual verification methods often involve long wait times while forms are reviewed, documents are checked, and decisions are made. Digital solutions streamline the process, enabling real-time verification. This saves both the business and the customer valuable time.

Online payment platform PayPal uses automated ID verification to onboard new users in minutes, creating a frictionless experience for its global user base.

3. Improved User Experience

Tedious onboarding processes deter otherwise enthusiastic customers or employees. Digital verification simplifies the experience, allowing users to complete steps quickly and securely, often from their mobile devices. The result is higher satisfaction and improved retention rates.

4. Cost Efficiency

While implementing digital identity verification requires an upfront investment, it eliminates recurring costs associated with manual checks, fraud remediation, and customer churn caused by poor onboarding experiences. Automated systems handle high volumes efficiently, reducing the need for extensive human resources.

5. Regulatory Compliance

Industries like finance and healthcare face strict regulations regarding customer onboarding. Digital identity verification solutions often integrate features to comply with laws such as Know Your Customer (KYC), Anti-Money Laundering (AML) directives, and GDPR, ensuring that businesses avoid costly penalties.

Real-World Applications and Success Stories

Industries across the board are adopting digital identity verification to improve onboarding processes:

- Financial Services: Banks like HSBC and digital-first entities such as Revolut use biometric authentication and AI-powered verification to onboard millions of users quickly while adhering to KYC regulations.

- Gig Economy Platforms: Companies like Uber and Lyft verify driver identities using facial recognition tools to ensure safety for riders and drivers alike.

- Online Education: eLearning platforms like Coursera verify user identities to maintain the integrity of certifications. Biometric and document verification ensures that enrolled students are who they claim to be.

Challenges in Implementing Digital Identity Verification

While digital identity verification offers numerous benefits, adopting such solutions is not without challenges:

1. Data Privacy Concerns

Collecting and storing personal data for identity verification raises serious concerns about user privacy. Businesses must ensure robust data encryption and comply with evolving data protection laws.

2. Implementation Costs

Setting up biometric systems or blockchain-based platforms requires significant investment in hardware, software, and training. Small to mid-sized enterprises might hesitate due to upfront costs.

3. User Adoption

Some users may resist digital identity verification technologies due to skepticism or lack of technical knowledge. Clear communication and user-friendly interfaces are critical to overcoming these barriers.

4. Error Handling with AI Models

While AI is highly accurate, it is not infallible. Algorithmic bias or data inconsistencies can result in verification errors, potentially leading to loss of business or reputational damage.

The Future of Digital Identity Verification

The evolution of digital identity verification is far from complete. Emerging trends suggest that future solutions will be even more secure, seamless, and accessible:

- Multi-Modal Authentication: Combining multiple biometric modalities, such as facial recognition and voice analysis, will enhance security.

- Decentralized Identity Ecosystems: Greater adoption of blockchain-based self-sovereign identities will empower users and increase data security.

- AI Advancements: Improvements in AI models will reduce false positives and negatives, making identity verification even more precise.

.jpeg)