Business agreements traditionally rely on a mix of written contracts, manual processes, and third-party intermediaries to ensure terms are fulfilled. While this model has functioned for decades, it suffers from inefficiencies, delays, and added costs. Then, there are smart contracts, a modern solution that revolutionizes how agreements are managed, executed, and enforced.

Smart contracts are self-executing agreements coded on blockchain platforms. They automatically execute actions when predefined conditions are met, offering a streamlined, secure, and transparent alternative to traditional agreements. From real estate transactions to supply chain management, smart contracts are reshaping operations across industries.

This post will explain the mechanics of smart contracts, explore their applications, highlight their benefits, and address the challenges accompanying their implementation.

What Are Smart Contracts?

Smart contracts are digital contracts embedded with specific terms and conditions that are automatically enforced without the need for intermediaries. They operate on blockchain networks, which store transactions in decentralized, immutable ledgers. This eliminates the potential for tampering and ensures trust between parties.

For instance, consider a lease agreement encoded in a smart contract. If a tenant meets the agreement's conditions (e.g., paying rent by the 1st of the month), the contract automatically grants access to a digital lock. If payment is missed, the contract’s terms might revoke access without requiring landlord intervention.

Key features of smart contracts include:

- Automation: Actions like payments, approvals, and service deliverables occur automatically when specific conditions are satisfied.

- Decentralization: Blockchain networks validate and record transactions, removing the need for middlemen like escrow services or banks.

- Immutability: Once terms are written and deployed, they can’t be altered, ensuring the integrity of the agreement.

Applications in Various Industries

Smart contracts have gained traction across a variety of sectors. Here are some prominent use cases:

1. Real Estate

Real estate transactions often involve time-consuming paperwork, title searches, and manual approvals. Smart contracts can simplify these traditional complexities. For example, contracts can automatically transfer property ownership to the buyer upon receipt of payment. This reduces reliance on brokers, notaries, and escrow services.

Additionally, rental agreements can be managed via smart contracts. Tenants can make automated payments directly through the contract, and landlords receive funds instantly without delay. This improves efficiency while reducing disputes over unmet terms.

2. Supply Chain Management

Supply chains are notoriously complex, involving multiple stakeholders across different regions. Smart contracts enhance transparency and efficiency through real-time tracking and condition-based transactions.

For example:

- Logistics Monitoring: A smart contract might ensure that payments are released to a shipping company only upon confirmation that goods have arrived at the designated destination.

- Product Authenticity: For industries like luxury goods or pharmaceuticals, blockchain-backed smart contracts ensure authenticity by tracking items at every stage of production and distribution.

A well-known example of supply chain smart contracts in use is IBM’s Food Trust platform, which leverages blockchain to enhance efficiency and traceability in food supply chains.

3. Finance and Insurance

The finance sector is one of the largest adopters of smart contracts. Consider the case of loans, where smart contracts can automate repayment by directly debiting borrower accounts once funds are disbursed. Similarly, insurance claims can process payouts automatically based on verified data inputs.

For instance, in automotive insurance, a smart contract might instantly settle claims upon receipt of accident reports and supporting evidence, reducing settlement times and eliminating disputes.

4. Healthcare

Healthcare agreements, such as those between providers and patients or insurers, can benefit significantly from smart contract technology. Patient consent, billing cycles, and pharmaceutical deliveries can all be automated to reduce errors and create a secure, verifiable ledger of interactions.

5. Entertainment and Royalties

Creative industries often struggle with ensuring fair and timely distribution of royalties. Smart contracts can automatically distribute payments to artists, writers, and producers whenever licensed content generates revenue. This ensures transparency and eliminates intermediaries who previously caused delays or deductions.

Benefits of Smart Contracts

The adoption of smart contracts brings several advantages to businesses and industries, beyond just convenience.

1. Eliminating Intermediaries

Traditional agreements often involve banks, notaries, brokers, or legal representatives to verify and enforce terms. Smart contracts effectively replace these intermediaries, reducing transaction costs and streamlining processes. This is particularly impactful in real estate and cross-border trade, where intermediaries add significant expenses.

2. Improving Efficiency

Smart contracts automate processes that are often slowed down by manual tasks. This leads to faster execution of agreements, enabling businesses to focus their resources on core functions. For example, supply chain participants can settle payments instantly once delivery conditions are met, avoiding delays caused by paperwork.

3. Enhancing Transparency

Blockchain technology, which underpins smart contracts, is inherently transparent. Every action taken within the framework of a smart contract is logged on an immutable ledger accessible to all parties involved. This reduces the potential for disputes and builds trust.

4. Boosting Security

Traditional contracts can be manipulated or falsified. Smart contracts, by contrast, utilize cryptographic encryption, ensuring secure and tamper-proof agreements. Once deployed, the terms of a smart contract are immutable, providing unprecedented reliability.

5. Reducing Errors

Manual contracts and processes are prone to human error. Misfiled paperwork, incorrect entries, or misinterpretation of terms can lead to costly mistakes. Smart contracts eliminate such risks by following precise coding logic, ensuring tasks are performed exactly as intended.

6. Global Accessibility

Smart contracts can be used anywhere in the world without the need for physical meetings or regional intermediaries. This promotes global collaboration and allows small businesses to compete on a larger scale.

Challenges of Smart Contracts

Despite their advantages, smart contracts are not without limitations. Businesses must understand and address these challenges before integrating the technology into operations.

1. Legal Recognition

Smart contracts are still a gray area in many jurisdictions, where courts and regulations may not fully recognize them as enforceable. This creates uncertainties, particularly for international transactions where varying legal frameworks come into play.

2. Technical Complexity

Smart contracts must be coded with precision to ensure they function as intended. Poorly written code can lead to vulnerabilities, including exploitation by malicious actors. Businesses must collaborate with highly skilled developers, which can be costly and time-intensive.

3. Scalability

Blockchain platforms currently face scalability concerns, particularly when processing high volumes of smart contracts. This limits the mass adoption of the technology, especially in industries with heavy transactional requirements.

4. Data Integrity

While smart contracts execute based on programmed conditions, the accuracy of external input data is critical. If the data sources or oracles used to feed the blockchain are flawed or tampered with, the execution of the contract can lead to incorrect outcomes.

5. Cost of Implementation

Setting up a smart contract framework involves initial costs, including infrastructure investments and training personnel. This might pose a barrier for smaller businesses.

(Image source: Midjourney)

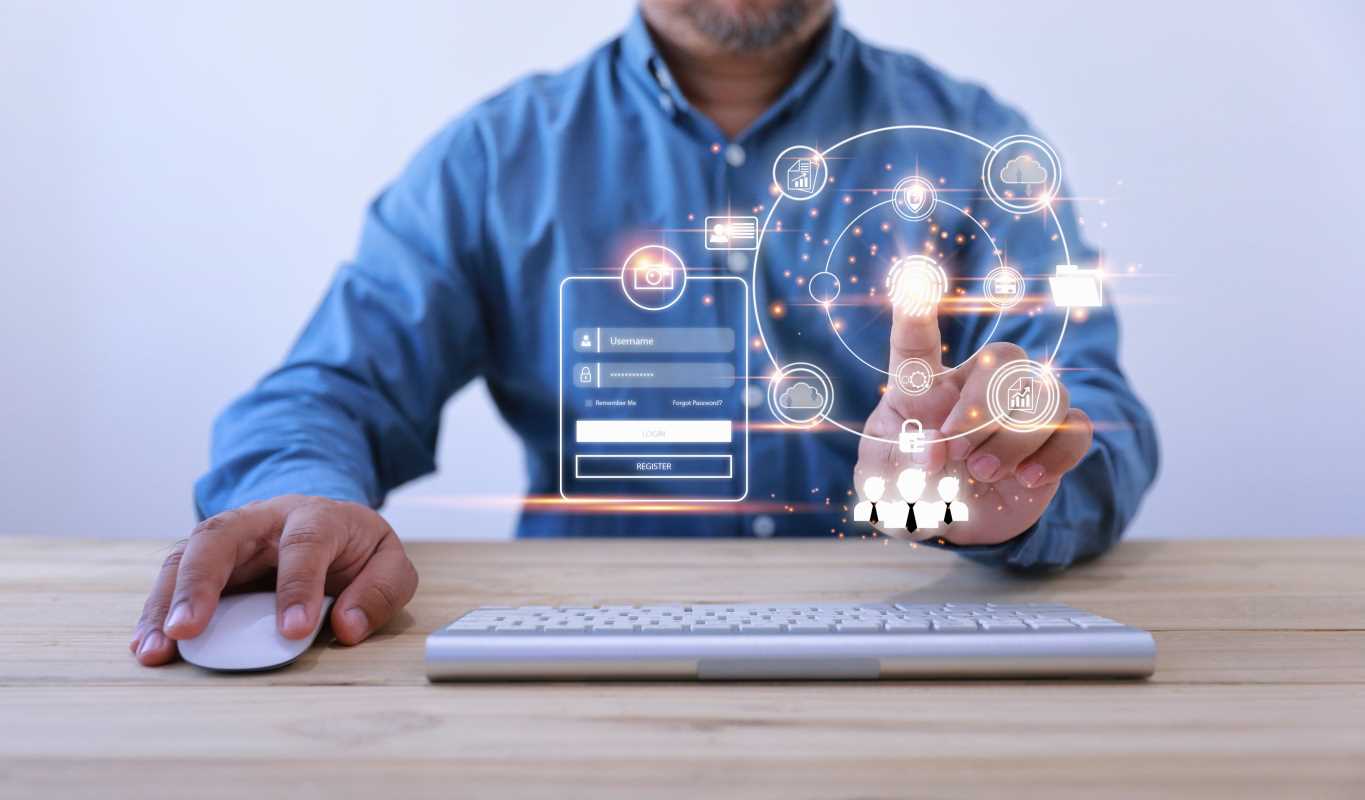

(Image source: Midjourney)

.jpeg)